China’s $8 Trillion Belt and Road Initiative and the Challenges Ahead

China’s Belt and Road Initiative (BRI), once a grand vision of reviving ancient trade routes and boosting global connectivity, has taken a turn. The ambitious program, pouring billions into infrastructure projects across the world, has now landed China in the unexpected role of the world’s largest debt collector.

Building Bridges, Accumulating Debts

Pexels | China has become a major financier for developing nations for roads, bridges, and ports.

Over the past decade, China has become a major financier for developing nations, doling out an estimated $1.3 trillion for roads, bridges, ports, and other infrastructure projects. This lending spree, often compared to the US Marshall Plan, fueled China’s global influence and established the BRI as a cornerstone of President Xi Jinping’s foreign policy.

The Tide Has Turned

Critics argue that BRI has left many countries burdened with unsustainable debts and environmental damage. Opaque project costs, often awarded to Chinese state-run firms, and rising global interest rates have further exacerbated the situation. As the loans mature, the question looms: how will China recoup its investments?

Facing the Reckoning

Instagram | 80% of China’s BRI loans went to countries already in financial distress.

A recent report by AidData paints a concerning picture. It estimates that a staggering 80% of China’s BRI loans are to countries in financial distress, with outstanding debts exceeding $1.1 trillion. Overdue repayments are soaring, and nearly 2,000 projects are at risk.

China’s Debt Collection Playbook

To navigate this complex landscape, China is employing a multi-pronged approach. It’s restructuring loans, providing rescue packages to debtor nations, and even demanding higher interest rates as penalties for late payments. This shift from infrastructure builder to debt collector marks a significant development in the BRI saga.

The U.S. and Europe Step Up

Instagram | The U.S. and Europe have launched their own initiatives to counterbalance China’s dominance.

Recognizing the BRI’s influence, the US and Europe have launched their own initiatives to counterbalance China’s dominance. The U.S., through its DFC, is actively financing infrastructure projects, while the EU’s ambitious Global Gateway program pledges nearly €300 billion for critical infrastructure development.

A New Era of Infrastructure Financing

The BRI’s debt woes offer both challenges and opportunities. While China grapples with its role as debt collector, the West sees a chance to lure affected countries back into its sphere of influence. The future of global infrastructure financing will likely be shaped by a complex interplay between these competing powers, with a focus on sustainability, transparency, and responsible lending practices.

More in News

-

`

NASA Brings Starliner Spacecraft Back to Earth Without Crew

In a significant development for the space industry, NASA has announced its decision to bring Boeing’s Starliner spacecraft back to Earth...

September 5, 2024 -

`

Clare Cavanagh’s Top 10 Funniest Moments on the Internet

When it comes to online humor, Clare Cavanagh is someone who knows her way around a good laugh. As a comedian...

August 29, 2024 -

`

House and Senate Unite to Boost Maternal Health Options Across Massachusetts

The Massachusetts Legislature is taking significant steps to improve maternal health care across the state, with both the House and Senate...

August 24, 2024 -

`

How to Fix a Broken Tooth? Essential Procedures and Care

Breaking or chipping a tooth can be alarming, but it’s often manageable with prompt dental care. If a tooth is chipped,...

August 9, 2024 -

`

Enjoy a Day of Fun at the Shark Petting Zoo in Florida

A visit to the shark petting zoo in Florida is an experience that combines excitement, education, and unforgettable memories. This unique...

August 1, 2024 -

`

Is Melania Divorcing Trump if He Secures a Second Term?

As Donald Trump campaigns for a potential second term, Melania Trump’s conspicuous absence from his side has sparked speculation. With Trump’s...

July 25, 2024 -

`

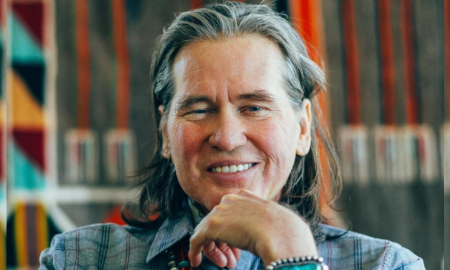

The Complete Relationship Timeline of Sam Rockwell and Leslie Ribb

When it comes to Hollywood couples, few are as enduring and beloved as Sam Rockwell and Leslie Bibb. Their relationship, which...

July 15, 2024 -

`

5 Handy Ways of Getting Blood Out of Sheets

Waking up to a blood stain on your bedding is an unpleasant surprise. Figuring out how to get blood out of...

July 10, 2024 -

`

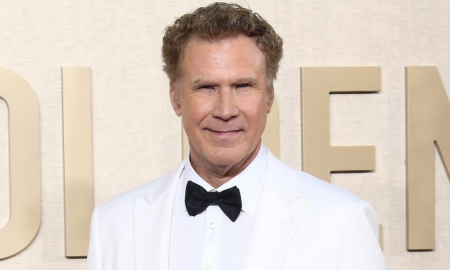

Will Ferrell’s Funniest Moments – The Best Quotes and Scenes

Will Ferrell, known for his outrageous humor and unforgettable characters, has delivered countless lines that have become ingrained in popular culture....

July 6, 2024

You must be logged in to post a comment Login